When a price floor is set above the equilibrium price as in this example it is considered a binding price floor.

Price floor above equilibrium quantity supplied.

A it results in a smaller quantity supplied than the quantity demanded otherwise known as a shortage.

When a price floor is put in place the price of a good will likely be set above equilibrium.

The result is a quantity supplied in excess of the quantity demanded qd.

Price floors prevent a price from falling below a certain level.

The equilibrium market price is p and the equilibrium market quantity is q.

Taxes and perfectly elastic demand.

B it results in a greater quanatity supplied than the quantity demanded otherwise known as a exceess supply.

In the price floor graph below the government establishes the price floor at price pmin which is above the market equilibrium.

Taxes and perfectly inelastic demand.

The effect of government interventions on surplus.

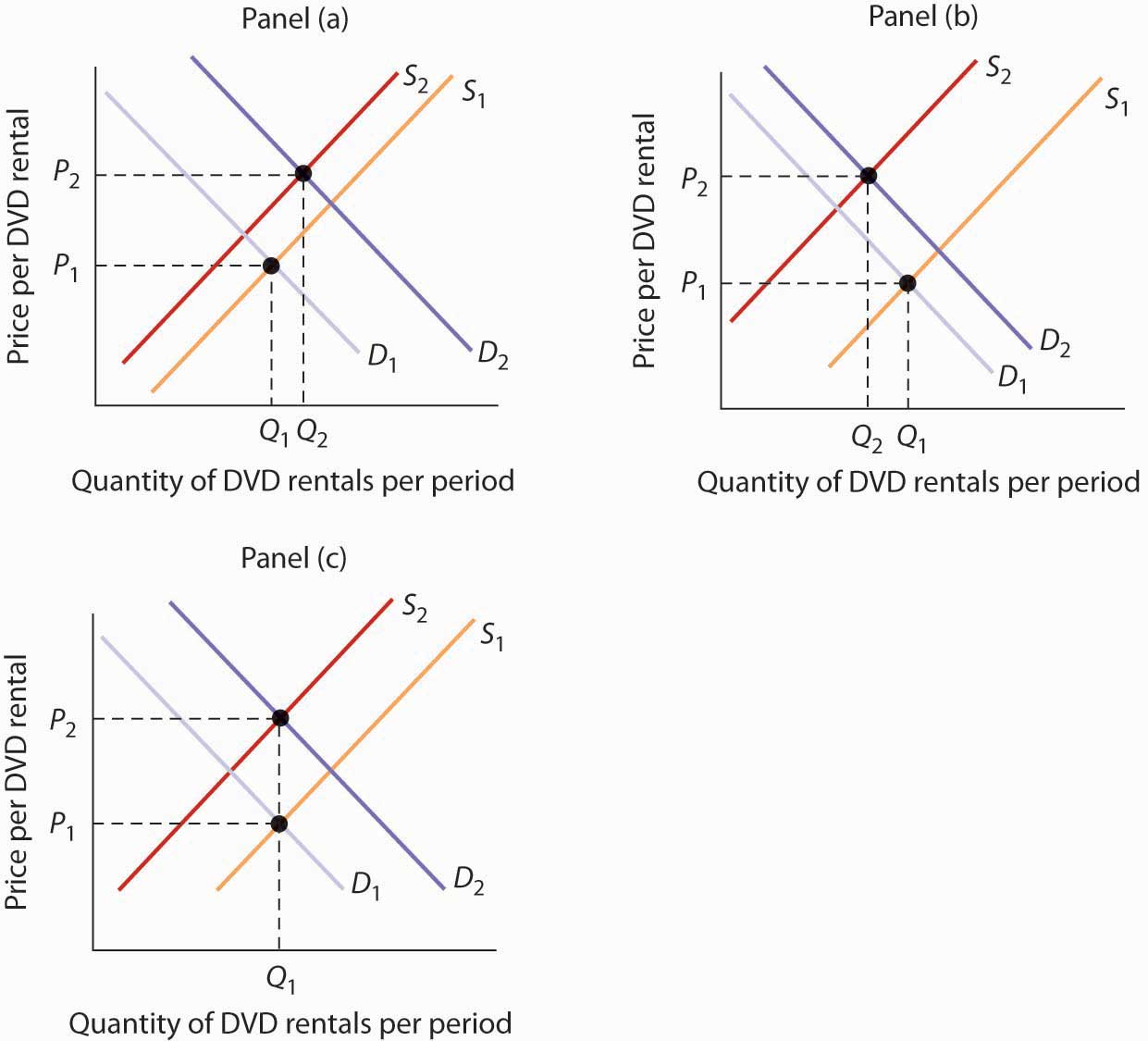

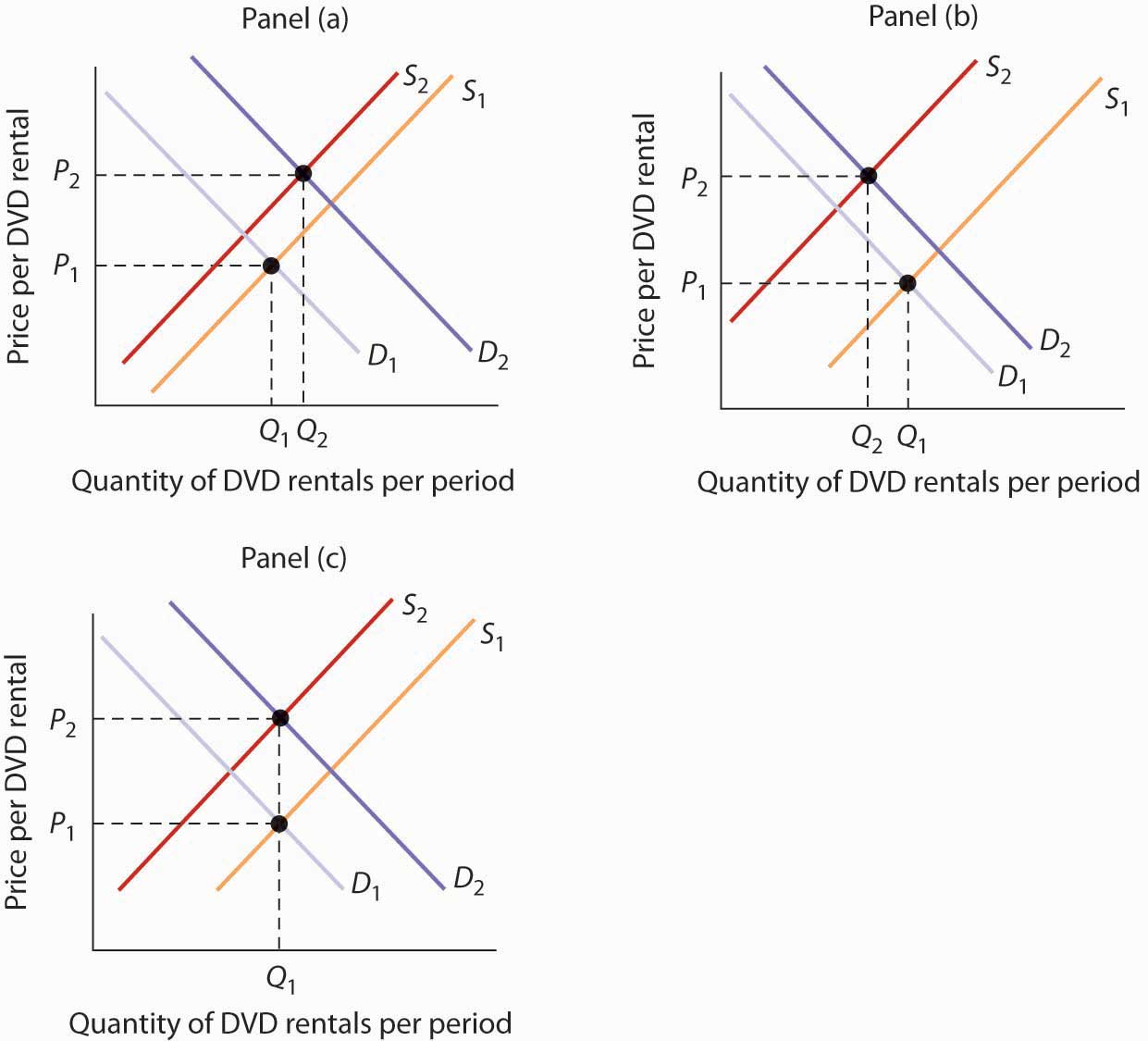

First of all the price floor has raised the price above what it was at equilibrium so the demanders consumers aren t willing to buy as much quantity.

When a price floor is set above the equilibrium price quantity supplied will exceed quantity demanded and excess supply or surpluses will result.

The market clearing price wage for unskilled labor equates the quantity demanded by employers with the quantity supplied by unskilled workers.

In such situations the quantity supplied of a good will exceed the quantity demanded resulting in a surplus.

Price and quantity controls.

Price floors and price ceilings often lead to unintended consequences.

When quantity supplied exceeds quantity demanded a surplus exists.

If the government sets a floor above the market clearing level then it will induce a surplus of unskilled labor.

F the price is above the equilibrium level the quantity supplied will exceed the quantity demanded so there will be a surplus.

At the price p the consumers demand for the commodity equals the producers supply law of supply the law of supply is a basic principle in economics that asserts that assuming all else being constant an increase in the price of goods will have a corresponding.

Example breaking down tax incidence.

How does a price floor set above the equilibrium price affect quantity demanded and quantity supplied.

There will be a supply glut meaning more workers are trying to find jobs at the going.

A surplus means businesses are producing more than they are selling.

Taxation and dead weight loss.

If a farm good.

Minimum wage and price floors.

Percentage tax on hamburgers.

In order to get rid of accumulating inventories firms will cut the price otherwise known as putting the good on sale as the price falls.